Calculating Virginia Child Support: A Simplified Guide

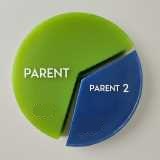

Virginia uses the “Income Shares Model”

The “Income Shares Model” calculates child support by considering each parent’s share of the total combined income of both parents. Imagine a pie representing the combined income of both parents. The child support amount for each parent is based on their “slice” of this pie.

The total amount of child support is determined by comparing the parents’ total gross income to a child support guidelines table, which can be found here. Adjustments are also made for certain costs and expenses such as health insurance and child care.

Here is a link to one of the court’s online child support worksheets for sole physical custody. A shared custody guideline worksheet may be found here.

The worksheets do not always provide the whole picture. Even though the worksheets suggest a “presumptive” amount, judges have the power to adjust it based on specific circumstances. This means the final figure might be higher or lower than the initial suggestion.

If you’re having trouble working with the forms, believe you have a basis for deviation upward or downward from the guidelines, or have specific questions, you may want to schedule a quick phone consultation.

Please scroll down for a more in-depth look at how child support is calculated:

- Using Guidelines to Calculate Virginia Child Support

- Determining “Gross Income” when calculating Virginia child support

- Using “Gross Income” to Determine the Virginia Child Support Guideline Amount

- Adjustment to the presumptive child support amount for health insurance and child care costs to calculate the final “presumptive” child support amount.

- Deviation – Rebutting the Presumptive Virginia Child Support Amount

- Imputation of Income as a basis for deviation from the Virginia child support guidelines

- Modifying a prior Virginia child support order

- The value of a consultation with a family law attorney when dealing with Virginia child support matters.

Calculating child support guidelines.

If you’re trying to estimate child support, you can use the worksheets and calculators provided by the courts as posted above to get an estimate of the amount of support that may be ordered in your case.

The first step is to determine the physical custody type, whether it is sole custody or shared custody. This will let you determine which worksheet to use. Generally, the custody type is shared if both parties have custody or visitation for more than 90 days of the year. A “day” means a period of 24 hours; however, there are provisions under the code that also allow for the allocation of one-half day periods. Calculation of half-day periods usually requires the assistance of a family law attorney.

Although the worksheets and calculators will give a support amount for both parents, only the noncustodial parent pays child support to the custodial parent. This is because courts assume that the custodial parent’s support amount is going directly to costs of supporting children.

After determining custody type and the correct worksheet to use, the next step is to calculate the parties’ gross income.

Determine “gross income” before calculating child support

The second step when calculating child support guidelines is a determination of the parties’ gross income. “Gross income” is defined as “all income from all sources”. It includes income from:

- salaries

- wages

- commissions

- royalties

- bonuses

- dividends

- severance pay

- pensions

- interest

- trust income

- annuities

- capital gains

- social security benefits (with some exceptions)

- workers’ compensation benefits

- unemployment insurance benefits

- disability insurance benefits

- veterans’ benefits

- spousal support

- rental income

- gifts, prizes or awards.

Gross income is subject to deduction of reasonable business expenses for persons with income from self-employment, a partnership, or a closely held business. “Gross income” does not include:

- Benefits from public assistance and social services programs as defined in Virginia Code § 63.2-100;

- Federal supplemental security income benefits;

- Child support received; or

- Income received by the payor from secondary employment income not previously included in “gross income,” where the payor obtained the income to discharge a child support arrearage established by a court or administrative order and the payor is paying the arrearage pursuant to the order. “Secondary employment income” includes but is not limited to income from an additional job, from self-employment, or from overtime employment. The cessation of such secondary income upon the payment of the arrearage shall not be the basis for a material change in circumstances upon which a modification of child support may be based.

Using “gross income” to calculate child support.

To find the basic child support obligation, add the parents’ adjusted gross incomes together and match the total with the column containing the applicable number of children in the Basic Child-Support Obligation Schedule. Using this link you can scroll down and find the current schedule of guidelines used in Virginia.

To find each parent’s percentage share of this basic amount, divide each parent’s income by the combined income.

For example, if the parents’ combined adjusted gross income is $10,000, with the noncustodial parent earning $7,000 and the custodial parent earning $3,000, the noncustodial parent would be responsible for 70% of support and the custodial parent for 30%. The basic child support amount in the schedule for one child when the parents’ combined monthly income is $10,000 is $1,054, so in this example the noncustodial parent would pay the custodial parent 70% of $1,054 or $737.80.

Health insurance and child care costs adjustments to child support.

The child support guideline amount calculated as above is finally adjusted for the costs of the children’s health insurance and work-related healthcare. These expenses are normally pro-rated between the parents using the income proportions calculated in the first step. Using the figures in the previous example, if the noncustodial parent pays $150 for health insurance and the custodial parent pays $350 for child care, 70% of the $500 total amount, or $350, would be the noncustodial parent’s responsibility and 30% of the $500 total, or $150, would be the custodial parent’s responsibility. The amount of $350 would be added to the noncustodial parent’s $737.80 support payment to get a new payment of $1,087.80. The noncustodial parent can subtract the $150 paid for health insurance, and the final support amount—called the “presumptive child support amount” in the guidelines—will be $1,081.30. The noncustodial parent will pay this amount to the custodial parent.

When Child Support Goes Beyond the Guidelines: Rebutting the presumption.

he Virginia child support guidelines provide a starting point for calculating support payments. However, there are situations where the standard amount might not be fair or reflect the true ability of each parent to pay, or the best interests of the children. In these cases, a court can choose to deviate from the guidelines.

What Does It Mean to “Deviate”?

Deviations require the court to make specific written findings explaining why the standard amount is unjust or inappropriate for your case. They must also show:

- The calculated child support amount under the guidelines.

- Why the final order differs from the guidelines.

- Evidence supporting the deviation, considering factors like:

- Financial Considerations:

- Support payments for other family members.

- Child custody arrangements and travel costs.

- Income imputed to a parent who intentionally reduces their income.

- Childcare costs related to a parent’s education or training.

- Marital debts incurred for child benefit.

- Court-ordered child-related expenses.

- Extraordinary financial gains (e.g., selling the marital home).

- Any special needs of the child.

- Independent financial resources of the child.

- Each parent’s income, debts, and financial resources.

- Marital property income or potential income.

- Tax implications for both parents.

- Other Factors:

- Written agreements between parents regarding child support.

- Other factors related to fairness for both parents and children.

- Financial Considerations:

Seeking a Deviation:

Deviations are complex and require clear evidence. If you believe your case warrants deviating from the guidelines, consult with an experienced family law attorney. They can help you understand the process, assess your chances of success, and navigate the legal system effectively.

When Child Support Goes Beyond Income: Why Judges Can “Impute” Earnings

Sometimes, parents try to lower their child support obligation by intentionally reducing their income. But what if a judge suspects this?

Judges can “impute” income: This means they estimate what a parent could be earning instead of relying solely on their current income. Here’s when that might happen:

- Voluntary income reduction: If a parent intentionally cuts their pay to avoid support, the judge might base the amount on their previous, higher earnings.

- Bad behavior impacting income: Getting fired for misconduct could lead to imputed income reflecting your past earnings.

But there are exceptions:

- Temporary hardship: If you’re temporarily unemployed or underemployed for a good reason, like pursuing better-paying skills to benefit your children, the judge will consider that.

Remember, every case is unique. This information is just a general overview. If you have concerns about imputing income or child support, consult a family law attorney for personalized advice.

Changing Child Support in Virginia: What You Need to Know

Modifying a child support order in Virginia is governed by Virginia Code § 20-108. This means a judge can:

- Change the order on their own: If they see fit.

- Change the order based on a request: From either parent, if circumstances justify it, which usually means there has been a significant change in a party’s financial situation.

Important points to remember:

- You can’t change the order retroactively: Any changes only apply from the date the request is filed.

- To change the order, you need a “material change”: This means a significant and long-lasting change in income or a child’s needs.

- Support typically ends at 18: Unless the child is still in high school full-time (until 19 or graduation).

- Support may continue past 18: If the child is disabled and cannot support themselves.

Confused? Need help?

This information provides a general overview, but each case is unique. If you have questions or need assistance modifying a child support order, contact a family law attorney experienced in Virginia law. A short consultation will help you answer any questions and decide how to move forward.